A while back, I did some foundational work for a leading biweekly payment service. That is, the math part, which I will reprise here. Biweekly works best in a climate of high interest rates and, unfortunately, soon after this project, the Federal Reserve dropped their reference rate to zero. The Fed has not been persistently above 2% until recently, and biweekly is once again looking good.

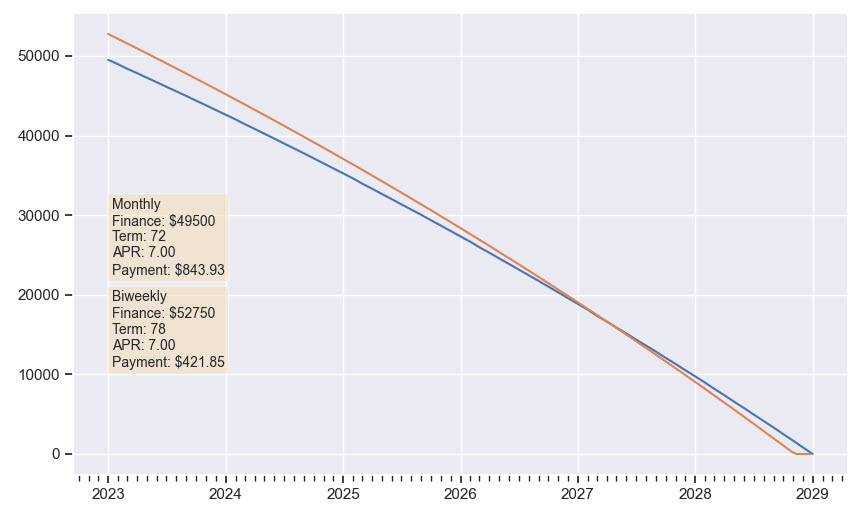

The featured chart shows a scenario first constructed by my erstwhile partner Phil Battista. I call it the “magic trick” because the customer in this scenario has financed an extra $3,250 with no change to the term, APR, or payment. Before presenting the trick, here are some basics about biweekly.

Biweekly Payment Plan Basics

In Canada, the banks offer loans with native biweekly payment schedules, and dealers feature them in their advertising. Here in the States, you have to use a service. The service collects payments biweekly via direct debit and manages the lender to accelerate the amortization.

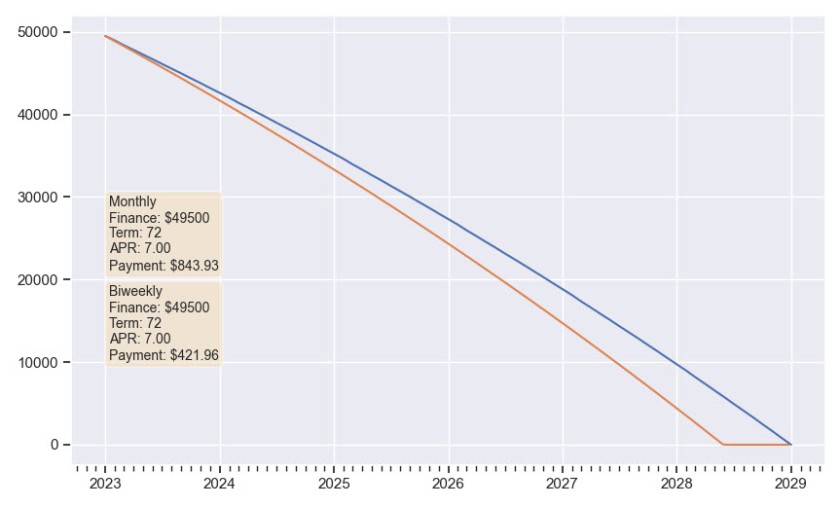

Here is an example. According to recent Cox data, the average price of a new car is now above $49,500 with an APR of 7.0% and a 72-month term. By the way, this survey does not include luxury brands, and some people are financing up to 84 months.

Below, I have modeled this “average” loan showing monthly versus biweekly payment schedules. This is showing the amortization only, omitting whatever fees the biweekly service may charge. You can see that the loan is paid off seven months early.

If you’re using longer terms to fit customers into payments, biweekly will shorten the trade cycle a bit. Also, credit-challenged buyers may be better off with direct debit synched to their paychecks.

Nostalgia Alert: coding for the U.S. Equity project was originally done in C# by my son, Paul, who would have been around fourteen at the time. We were making an OO model to include all loan and lease instruments as subclasses. Coding for this article was done by me, in Python, which is 10X easier.

The Magic Trick

If you compare the two charts above, you can see graphically how Phil’s trick works. Instead of starting your biweekly loan at the same amount and having it end earlier, you start it higher and aim to end on the same date.

The trick works because half the monthly payment is higher than a native biweekly payment would be – by $33 in this example. The customer makes the equivalent of thirteen monthly payments per year, and the bank loses a little bit of interest income. Here are the steps:

- Increase the amount financed, which will increase the monthly payment.

- Increase the term until the monthly payment comes back down to where it was.

- Use the biweekly program to bring the term back down to where it was.

Congratulations, you can now finance more product with the same monthly payment. I covered the concept for menu systems in Six Month Term Bump. To do goal seeking, as I’ve shown here, you will need some Python (or a precocious teenager).